Last time we looked at how to grow your wealth. This time we’re asking how you can protect it. And how can you smooth the ride along your investment journey?

The background

Investing is not just about growing wealth or making your pile bigger; it’s also about protecting what you have and moderating the ups and downs. Risk protection is a key part of a smart investment strategy.

But before you just stick your money under mattress, it’s wise to reflect on the fact that risk can mean different things to different people. That means there are many different strategies to manage these various risks.

For many people, the most commonly perceived risk is market risk. If the share market falls sharply, you lose money, on paper at least. But this only matters if you plan to sell tomorrow. If your horizon is long, these daily ups and downs will matter less.

If you’re investing internationally, the ups and down of currency markets can affect the value of your portfolio in your home country. And if you’re invested in bonds, risks are posed by rising inflation, changing interest rates or a bond issuer defaulting on their payments.

Allied to market risk is volatility. The degree your investments rise and fall from year to year can affect your outcomes in a couple of ways. Firstly, there’s the stress that volatility can cause. Some people just aren’t as well equipped to deal with the ups and downs. Secondly, volatility can also have a real cost on your portfolio, as we shall see.

You can deal with volatility through diversification. That means spreading your investments so you are not overly dependent on individual asset classes, countries, sectors or stocks. So, when one component zigs, another may zag. Think of it like shock absorbers in your car. Without them, you’re going to feel every bump in the road. With them, the ride will be much smoother.

The detail

Diversification is often described as the only “free lunch” in investing. The flavour sensation of higher returns also can come with the indigestion of higher risk.

But you can moderate the range of possible outcomes by ensuring you are not too exposed to any one ingredient. Think of it like a buffet full of different dining choices.

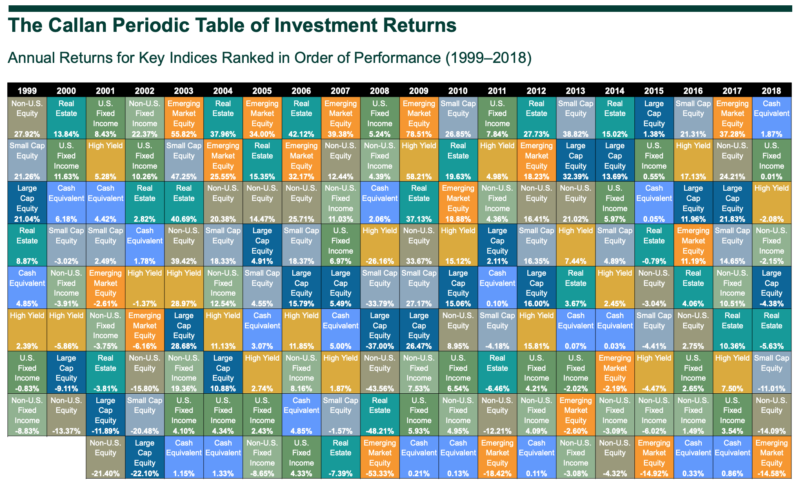

Illustrating that concept is the chart below, which shows how different asset classes or countries perform year to year. As you can see, there is no discernible pattern. It’s hard to know which will be the best one next year.

Equities have done best over the long term, but there also have been shorter periods where they have lagged bonds. In some years, small company stocks do well; in others the large ones do better. Low relative price stocks sometimes are among the top performers. Other times, they lag. Sometimes, emerging markets do best. Other times, it’s developed markets. This lack of a predictable pattern applies to individual countries, too.

Diversification matters because volatility can have an impact on your returns over time.

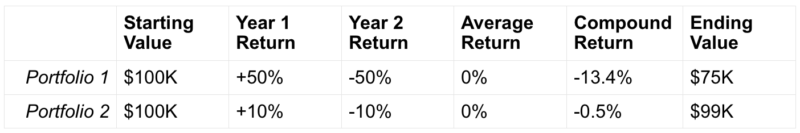

Let’s look at two portfolios, both starting with $100,000. Portfolio 1 takes a concentrated bet on one market, while Portfolio 2 is globally diversified. Both portfolios have the same average return over two years of zero. Yet Portfolio 2 has the far better outcome. Why is that?

The reason is that Portfolio 1 is more volatile. Diversified Portfolio 2’s lower volatility produces a higher compound return and preserves more of its original value.

The lesson is that if two portfolios have the same average return, the one with the lower volatility will always have a higher end value.

Of course, you could just stick to your home country. It’s what you know, after all. But this “home bias” also carries risks as well. Just as the performances of asset classes and individual sectors vary, so can those of countries. Think of Japan in the 1980s. Its market appeared unstoppable. Then it spent more than two decades in the doldrums.

Occasionally, the media gets excited about individual industries. Think about what happened in the early 2000s when the world was going crazy for technology stocks. It was a great bet while it lasted, but then it all came crashing down. Again, you can deal with this by spreading your allocation across different sectors, by diversifying internationally – and by keeping an exposure to all the drivers of expected return.

Falling in love with individual stocks is another risk you don’t need to take. If your gamble pays off, great! But it’s speculation. It’s not investment. You’re taking a bet that those companies will continue to dominate. Back in the 1960s, the media swooned over the ‘Nifty Fifty’, blue chips that would never let you down – names like Xerox, Eastman Kodak, IBM and Polaroid, all of whom were disrupted over the years. Nothing stays the same. That’s why you diversify.

Other risks

As for foreign exchange risk, you can ‘hedge’ (a type of insurance) overseas returns to your home currency. But there is no evidence that this makes a difference to long-term returns. If you fully hedge your exposure and your home currency rises, all well and good. But if your home currency falls, you risk missing out on the kicker you get by converting the now more valuable foreign exchange. One answer is to hedge 50% of your overseas exposure and leave the other half unhedged.

While bonds are less volatile than shares, they still have their risks. The three main ones are rising inflation, increasing interest rates and default.

Inflation reduces the purchasing power of bonds. The income you were counting on suddenly buys less than it once did.

When a central bank increases interest rates, the prices of existing bonds can drop because their coupon rates look less favourable.

Default occurs when a bond issuer can’t repay what they owe.

Again, you can manage these risks by diversifying across different countries and currencies, and across government and corporate bonds.

Liquidity risk refers to difficulty in getting access to your money. So-called ‘alternative’ investments often carry this risk. You can manage liquidity risk by always having sufficient cash on hand to keep you going in an emergency.

Finally, there is longevity risk, which means outliving your money. We’re all living longer, which isn’t necessarily a bad thing. But how do you ensure your savings last you through retirement? There are new, innovative ways of dealing with this risk.

The evidence

Much of the work on diversification and risk dates back to the early 1950s and the research of Harry Markowitz, a pioneering American economist who founded what became known as ‘modern portfolio theory’ and who was recognised with the Nobel Prize in 1990.

Markowitz described as an “efficient” portfolio one that provides a maximum return for a given level of risk, or put another way, a minimum risk for a given level of return. You can achieve this by combining different securities or assets that behave differently. This way you can increase the chance of a smoother investment journey without giving up on return.

The aim for an investor should be to reduce ‘diversifiable’ risks, or risks they don’t need to take, to get to their goals. These are risks related to individual companies, sectors, countries or asset classes. This contrasts with systematic or non-diversifiable risk, like the risk of the market itself. You deal with the former risk by mixing up different assets.

As it can be costly, time-consuming and complicated for an individual to manage all these investments, it makes sense to get that exposure through a professionally managed fund in a pool with many other investors. This is a more convenient and efficient way of investing in securities and assets that might otherwise be difficult to access.

Next time: Choosing a strategy

Also in this series:

Part 1: Starting with evidence

Looking for a financial planner with an evidence-based investment philosophy? We may be able to help you. Click here for more details.

This content, and indeed all of the content you will find on The Evidence-Based Investor, is for informational, entertainment or educational purposes only and should not be construed as investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

COPYRIGHT

Regis Media owns the copyright to all of TEBI’s content, and republishing any of it without permission is strictly prohibited. We will take appropriate action in the event of any infringements.

Financial advisers may wish to note that we allow selected firms to use our investor education content under licence, and that we also produce original and customised articles and videos. Visit our website for further information.