A value premium update for the not very interested

- Robin Powell

- Feb 6, 2021

- 3 min read

Updated: Nov 27, 2024

Mention the value premium to investors and chances are their eyes will glaze over. Most have never heard of it — and many who head of it probably can’t remember what it is.

But, believe us, this stuff is important, so please bear with us while we give you a quick update.

This article was produced for Global Systematic Investors, an evidence-based fund management company that combines systematic factor investing with an ESG overlay.

Academic researchers have shown that, in the long run, value stocks have historically produced higher returns than stocks trading at higher prices, otherwise known as growth stocks. This pattern is known as the value premium.

The value premium has been shown to be persistent over time, cost-effective to capture and prevalent across markets. Over time, therefore, portfolios that have a heavier weighting in value stocks outperform the broader stock market.

They’ve done OK. Apart from the occasional steep decline like the one we saw in March last year, equities generally have been on an upward trajectory since the end of the global financial crisis. Since the start of 2010, value stocks specifically have performed in line with their longer-run average since 1990 (8.7% vs. 9.0%).

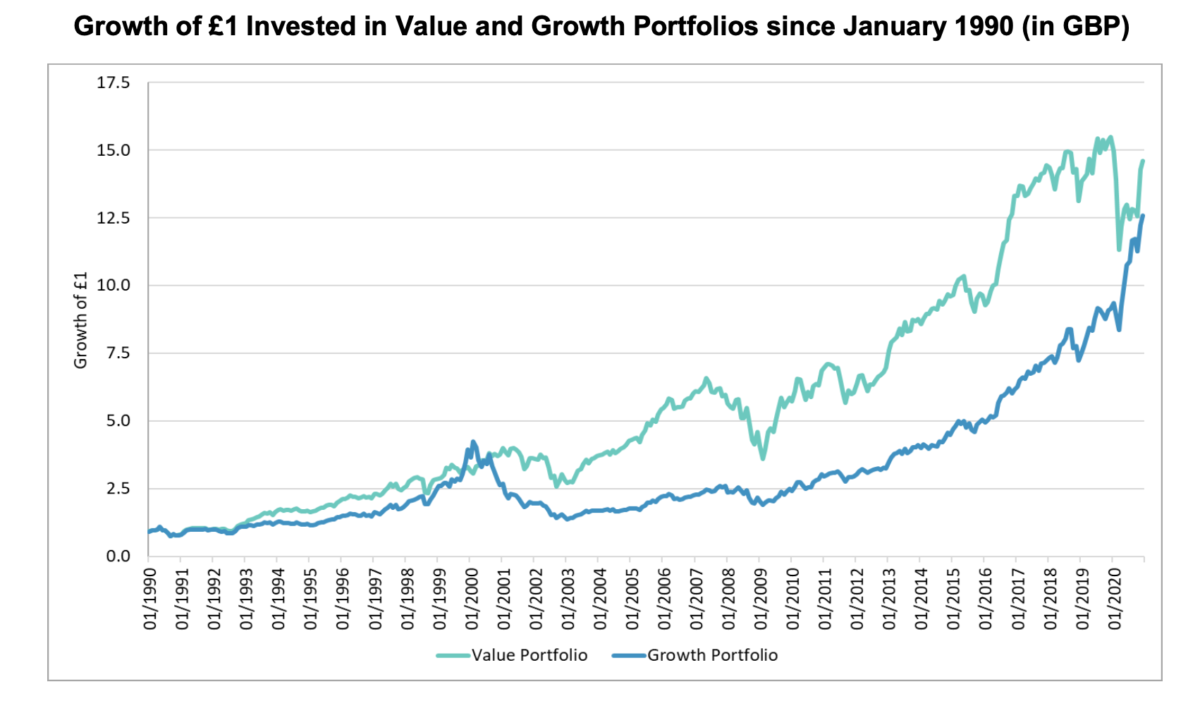

That said, growth stocks have been doing even better. As you can see from the chart below, they have outperformed value stocks since the year 2000. In other words, investors with a heavier exposure to value stocks have not seen any benefits for the last two decades.

Source: GSI

Yet again last year, growth stocks produced a higher return than value stocks. Interestingly, this was largely driven by the so-called FAANG stocks — Facebook, Apple, Amazon, Netflix, and Google (now called Alphabet). As you can imagine, these technology stocks benefited greatly from the global pandemic and the fact that most of us were stuck at home for long periods.

Another standout case was Tesla, which rose 743% during 2020. This may have been partly driven by its inclusion in the S&P 500 index, which meant that US index funds that are benchmarked to this index had to buy it, even at what was widely regarded as an elevated price.

For an investor, worrying is never a good idea. The important thing is to stay rational and focus on the long term.

There are no guarantees in equity investing, and it’s by no means certain that value stocks will produce long-term outperformance in the future. But successful investing is all about putting the odds in your favour. On average, since 1927, value has provided a premium in the region of 4% a year. It’s highly likely that the value premium will reappear at some stage, and possibly sooner than you think.

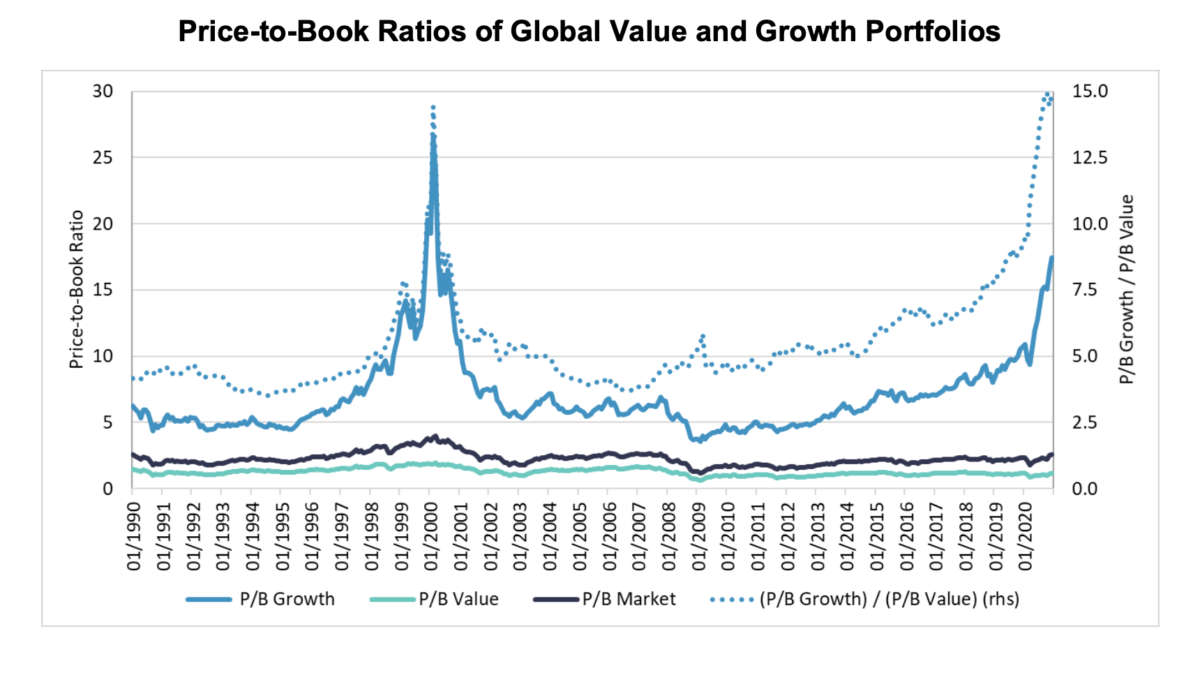

Well, a useful guide to future expected returns is what we call the price-to-book (or P/B) ratio. Simply put, the P/B ratio measures the market's valuation of a company relative to its book value.

You’ll see from the chart below that the P/B ratio of growth stocks has been trending up since the onset of Quantitative Easing (QE) in early 2009. However, in 2020, the price of growth stocks was pushed up much further so that their weighted average P/B ratio at the end of the year was 17.4. This compares to a long-run average of 7.0 since 1990. Though somewhat below the peak of 26.6 reached in February 2000 during the tech boom, 17.4 is still very high.

Source: GSI

By historical standards, yes — that’s certainly what the relative P/B ratios suggest. But again, there are no guarantees when it comes to future performance.

Whether the valuation spread between growth and value stocks continues depends on things we can’t predict with any uncertainty. For example, will the new Biden administration have any impact on the strong earnings and dominant positions of those FAANG stocks we mentioned? And for how much longer will interest rates remain at such low levels?

Because investors are human, they naturally tend to attach more weight than they should to the recent past. We call that recency bias. One of the most important lessons from market history is that nothing lasts for ever. And that includes the seemingly ever-increasing valuation spread between growth and value.

As we always point out, we are not financial advisers, and we strongly encourage people to seek the help of an adviser before making any significant changes to their portfolio.

Suffice it to say, abandoning value now is probably not a shrewd move. And for those who don’t yet have exposure to value stocks, this might turn out to be an excellenttime to talk to their adviser about getting some.

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.