Deep value is an investment strategy that involves buying the cheapest stocks, based on their valuation multiple. If you like, it's a super-charged version of value investing. Value stocks come with higher risk but higher expected returns in the long run. Deep value stocks are riskier still, but, in theory at least, patient investors can expect them to deliver superior returns. Timing factor strategies is extremely difficult. But what does the evidence tell us about the prospects for deep value at a time like this, when interest rates are rising and there are fears of a recession? LARRY SWEDROE has been evaluating the evidence.

Over the roughly 95 years for which we have data for U.S. stocks, the value premium has averaged 4.2 percent per year. In our book Your Complete Guide to Factor-Based Investing, Andrew Berkin and I presented the evidence demonstrating that the value premium was persistent across time and economic regimes, pervasive around the globe, robust to various definitions, survived transactions costs, and had both risk and behavioral explanations for why investors should expect the premium to persist in the future. Thus, the finding of a value premium was highly unlikely to be the result of data mining exercises.

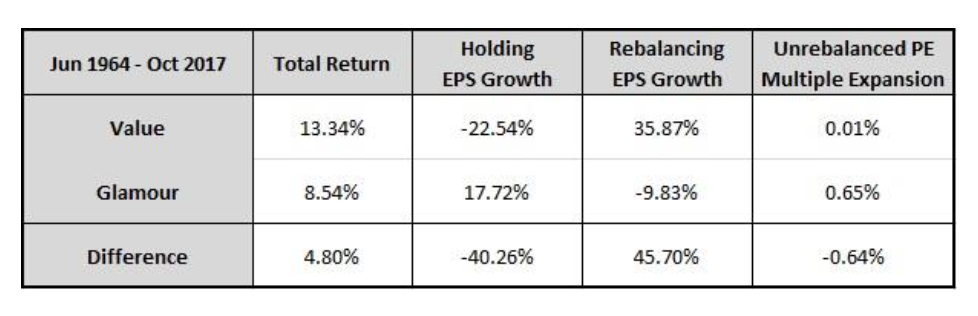

To determine how buying stocks with cheaper valuations had outperformed, in their May 2018 study Factors from Scratch: A look back, and forward, at how, when, and why factors work, Chris Meredith, Jesse Livermore and Patrick O’Shaughnessy of O’Shaughnessy Asset Management (OSAM) analysed U.S. equity data over the period June 1964-October 2017 (I highly recommend reading this paper). Their findings led them to draw the following conclusions about value stocks:

Companies generally fall into the “value” category because of some underlying uncertainty in their earnings trajectory. This uncertainty is reflected in a lower stock price, and hence a lower valuation.

An annually value strategy systematically buys into this uncertainty, anticipating that the companies’ underlying fundamentals are more stable than the pessimistic views embedded in the cheap price — the expectation being that prices will converge on their fair values.

As value companies’ fundamentals stabilise in years two to four of a hold period, their valuation continues to re-rate through multiple expansion. This multiple expansion begins in advance of an improvement in fundamentals, with the steepest re-rating occurring in the first 12 months of a hold period. The initial return boost from multiple expansion generally offsets the earnings weakness in the first 12 months prior to stabilisation, resulting in a value premium.

International evidence

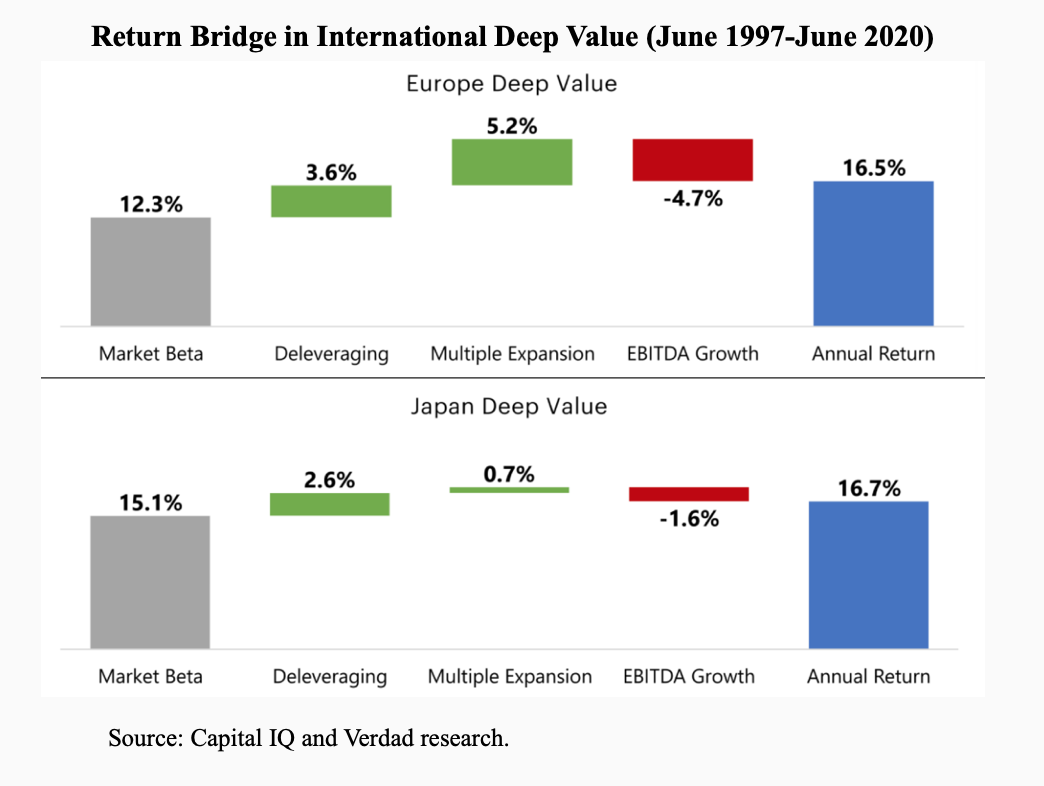

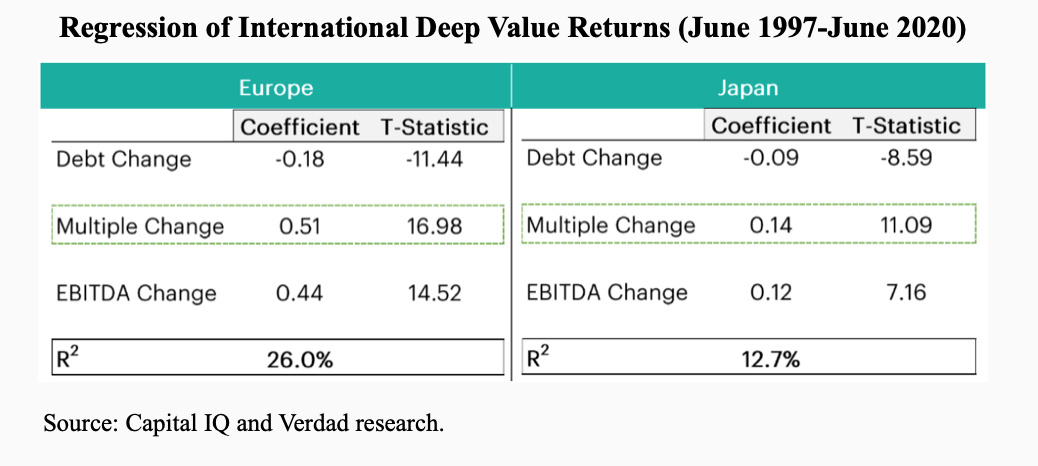

In their study Drivers of Deep Value: International Evidence, Brian Chingono and Nick Schmitz of Verdad examined whether OSAM’s findings held in developed international markets. In addition to examining multiple expansion and EBITDA (earnings before interest, taxes, depreciation and amortisation) growth, they also explored the relationship between the change multiples and leverage. Thus, their analysis was based on a regression of one-year forward returns in international deep value companies against three explanatory factors: deleveraging over the next year, multiple expansion over the next year, and EBITDA growth over the next year. As seen in the table below, their findings in Europe and Japan were broadly similar to the original U.S. research, as multiple expansion tended to more than offset earnings weakness during the first 12 months of holding international value portfolios. A major contribution of their work was that they also found that deleveraging was an important contributor to returns in deep value strategies — the magnitude of return contribution from deleveraging was economically meaningful in deep value, at around 3 to 4 percentage points per year.

Chingono and Schmitz explained: “Deleveraging and multiple expansion tend to contribute positively to returns in deep value, while earnings growth tends to be a negative contributor over a one-year hold. Consistent with the US research from OSAM, this is because value strategies buy into uncertainty at each rebalance, and it takes about 12 months for earnings to stabilise. In anticipation of that stabilisation, forward-looking investors begin to re-rate the companies’ valuation multiple within those first 12 months, providing a return boost through multiple expansion. At the same time, companies that are facing economic uncertainty have every incentive to pay down debt and strengthen their balance sheet. Hence, we also see a positive return contribution from deleveraging in the first 12 months of holding a deep value portfolio.”

For example, as seen in the following table, in the European sample the average change in net debt was a -20 percent reduction, and multiplied by a coefficient (i.e., sensitivity) of -0.18 provides a positive return contribution of 3.6 percent from deleveraging over a one-year horizon.

Investor takeaways

As Chingono and Schmitz noted, their findings provided good news for value investors.

First, the high likelihood of rising interest rates will provide companies with leverage an incentive to pay down their debt (or at least not borrow a lot more) to contain interest expenses. The authors explained: “This driver is particularly attractive for European deep value where levered companies dominated the universe in the data shown above and continue to do so today.”

Second, valuation multiples have historically been mean reverting, and the dramatic underperformance of value over recent years has left deep value trading at near record valuation spreads in almost all geographies.

“And third," Chingono and Schmitz concluded, "there is one exception to the general rule of earnings growth being a drag on deep value returns: during recoveries from recessions, value stocks grow like growth stocks, as we’ve shown both in Japan and Europe.”

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.