By CRAIG LAZZARA

Traditional investors think of portfolios (whether active or indexed) as collections of . We can equally well think of portfolios as collections of — defining factor in the academic sense, as an attribute with which excess returns are thought to be associated. If we’re correct in assessing these attributes, it should be possible to explain portfolio performance by reference, not to the stocks that the portfolio owns, but rather to the factors that it embodies.

One way to illustrate this is with reference to factor indices. It’s obvious, for example, that a well-constructed value index is tilted toward cheap stocks (i.e. toward the value factor), but it’s equally true, if less obvious, that a value index might have other tilts as well — for example, toward smaller companies, or higher yields, or lower quality. If this is true, then the performance of factor indices might be explained, in part, by reference to multiple factor exposures.

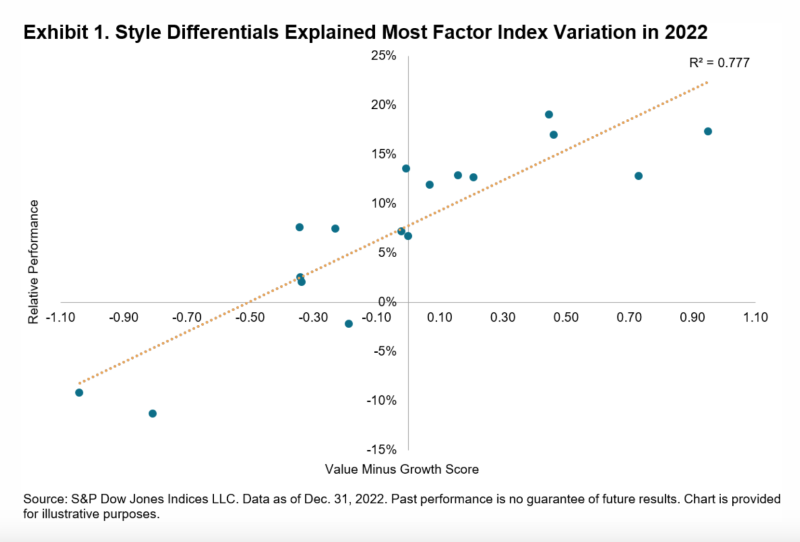

We’ve noted before that one of the most salient features of 2022 factor index performance was the reversal of several multi-year trends. Equal weight beat cap weight, Low Volatility beat High Beta, and most strikingly, Value outperformed Growth. The Value-Growth differential was so large, in fact, that it explained nearly 80% of the variance in returns across other factor indices, as Exhibit 1 illustrates.

Exhibit 1, though interesting, relies on data from only 17 factor indices. Some stocks will be represented in several of these indices, while others might not be included in any. What happens if we ask how factor exposure affected performance at the individual stock level?

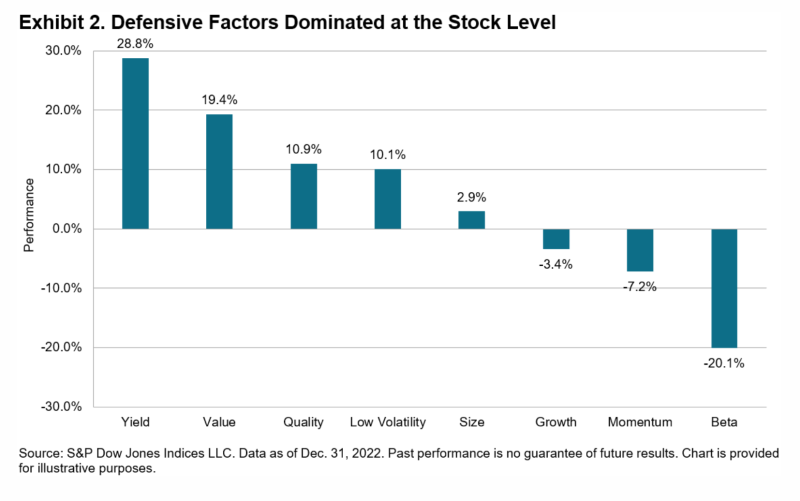

We can approach this question by ordering the constituents of the S&P 500 by the factors of interest, grouping into quintiles, and then measuring returns by quintile. The difference between top and bottom quintiles (i.e., between the average return of the stocks most exposed to the factor and the average return of those least exposed) gives us a convenient way to summarise each factor’s influence. Exhibit 2 shows results for 2022.

Yield was the year’s strongest factor by far, as the market’s highest dividend payers beat non-payers by nearly 29%. Value was in second place, with defensive stalwarts Quality and Low Volatility filling out the top four places. The difference between the performances of Value and Growth is quite consistent with the observations we made in Exhibit 1.

Other things equal, as granularity increases, the importance of factors declines. An individual stock will be more heavily influenced by idiosyncratic factors than will be a diversified portfolio. Even at the stock level, however, understanding factor exposures can produce useful performance insights.

CRAIG LAZZARA is Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices.

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.