Beating the index over meaningful timeframes — over, say, 20, 25 or 30 years — is extremely challenging. Only a very small proportion of actively managed funds succeed in doing it on a cost- and risk- adjusted basis. Not only that, most funds struggle to outperform over much shorter periods. In 2020, for example, just 12% of funds beat the headline index for the Candian equity market, the S&P/TSX Composite Index. Here's S&P's BERLINDA LIU wit the latest data.

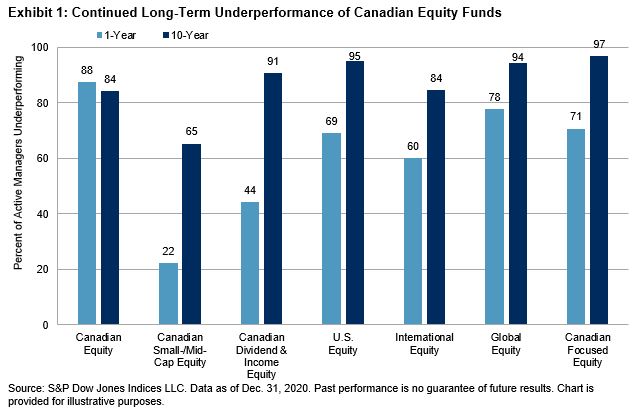

Although 2020 was a year that offered ample opportunities for stock pickers to shine, most Canadian active fund managers in five of the seven categories tracked by the SPIVA Canada Year-End 2020 Scorecard underperformed their benchmarks over the past year.

The Canadian equity market was not spared from the COVID-19 shock in 2020. Nevertheless, major local equity benchmarks finished positive, with the exception of the S&P/TSX Canadian Dividend Aristocrats Index. Among actively managed Canadian equity funds, 88% lagged the S&P/TSX Composite Index. Canadian Small-/Mid-Cap Equity funds had a banner year, as just 22% failed to beat the S&P/TSX Completion Index. Canadian Dividend & Income Equity funds took second place among fund categories, with just 44% lagging the S&P/TSX Canadian Dividend Aristocrats Index.

Results were more uniform and bleaker over longer horizons. At least 84% of Canadian fund managers underperformed their benchmarks in all but one category over the past decade.

Equity funds looking outside of Canada performed better than their domestic-focused peers on an absolute return basis, but still generally underperformed the benchmarks. Thanks to a strong rebound in the U.S., equity funds there posted the highest returns over the past year among all categories, with a 13.6% gain on an equal-weighted basis. However, this was still below the 16.3% return of the S&P 500 (CAD), and 69% of the funds still fell short of their benchmark.

Larger funds in Canada tended to outperform their smaller counterparts, as 22 of the 28 results showed higher asset-weighted returns across the seven fund categories and four investment horizons in the report.

The data from the SPIVA Canada Year-End 2020 Scorecard show disappointing performance of active funds relative to their respective benchmarks. Over the past decade, most Canadian fund managers in all categories failed to beat index investing.