Momentum and high beta: what's the difference?

- Robin Powell

- Apr 24, 2023

- 2 min read

Updated: Oct 23, 2024

Momentum investing is a strategy that aims to take advantage of continuing trends. Closely related to momentum is what's called high beta. But despite their similarities, momentum and high beta sometimes produce very different returns, as CRAIG LAZZARA explains.

In the first quarter of 2023, the best performing of the 17 factor indices featured in our monthly factor dashboard was S&P 500 High Beta (up 12.5%), while the worst performer was S&P 500 Momentum (-3.2%). This may seem odd at first blush, since both indices are, in some sense, performance chasers — Momentum in absolute and High Beta in relative terms. This admitted oversimplification ignores differences in rebalancing schedules, lookback periods, and risk adjustments, yet investors who wonder about the gap between the two indices’ performance are asking a reasonable question.

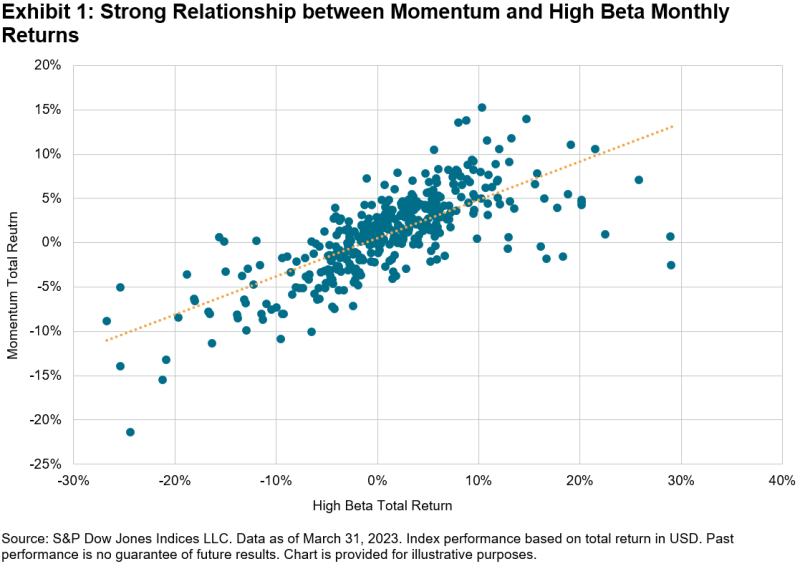

Exhibit 1 shows the relationship between the monthly returns of Momentum and High Beta. The historical correlation was an impressive 0.73, as the indices tend to rise and fall together.

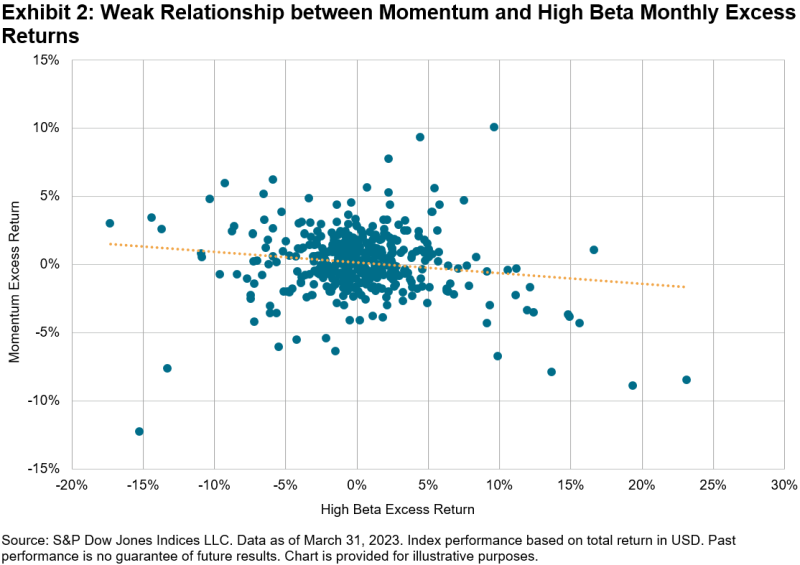

This comparison, of course, ignores the impact of the market as a whole on the movements of both factors. Exhibit 2 corrects for this oversight by subtracting the return of the S&P 500 from those of both factor indices. The prior strong relationship evaporates, as the correlation of monthly returns is only -0.15. Net of the market’s impact, there is essentially relationship between the returns of Momentum and High Beta.

In part, this stems from a subtlety in the construction of the two indices. High Beta seeks to measure the S&P 500’s highest-beta stocks. , presumably the highest-beta stocks will be among the market’s best performers, and therefore might also be expected to turn up in Momentum. , however, presumably the highest-beta stocks will be among the market’s worst performers, leading Momentum to tilt toward lower-beta constituents. This helps explain the specific differences observed during the first quarter of 2023, following the S&P 500’s 18% decline in 2022.

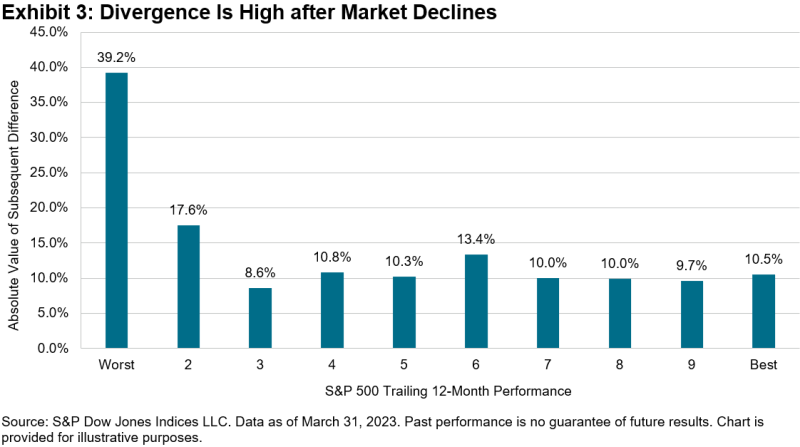

If this explanation is correct, it suggests a general pattern: when the market has risen, the performance of Momentum and High Beta might be similar; when the market has fallen, their performance is likely to diverge. To test this hypothesis, we formed deciles in our historical database, sorted by the trailing 12-month return of the S&P 500. For each decile, we computed the average subsequent 12-month absolute difference between the returns of Momentum and High Beta.

As Exhibit 3 shows, when S&P 500 performance was in its worst decile (with an average decline of 22.5%), the difference between Momentum and High Beta averaged 39.2%. In the second decile (with the S&P 500 down 2.8% on average), the difference falls to 17.6%. In the other eight deciles (where the S&P 500’s performance averaged 18.3%), the difference between Momentum and High Beta was a comparatively small 10%.

We’ve often written about the importance of the market environment in evaluating factor index performance and in considering factor combinations. It can be no less important in illuminating factor differences.

© The Evidence-Based Investor MMXXIV. All rights reserved. Unauthorised use and/ or duplication of this material without express and written permission is strictly prohibited.