By LARRY SWEDROE

While traditional asset pricing theory assumes investors to be “economically rational” and to use all available information when choosing between risky assets, research from the field of behavioural finance has found that investors are not fully economically rational. Instead, they are “psychologically rational”. For example, salience theory suggests that decision-makers exaggerate the probability of extreme events if they are aware of their possibility, giving rise to subjective probability distributions that undermine conventional rationality.

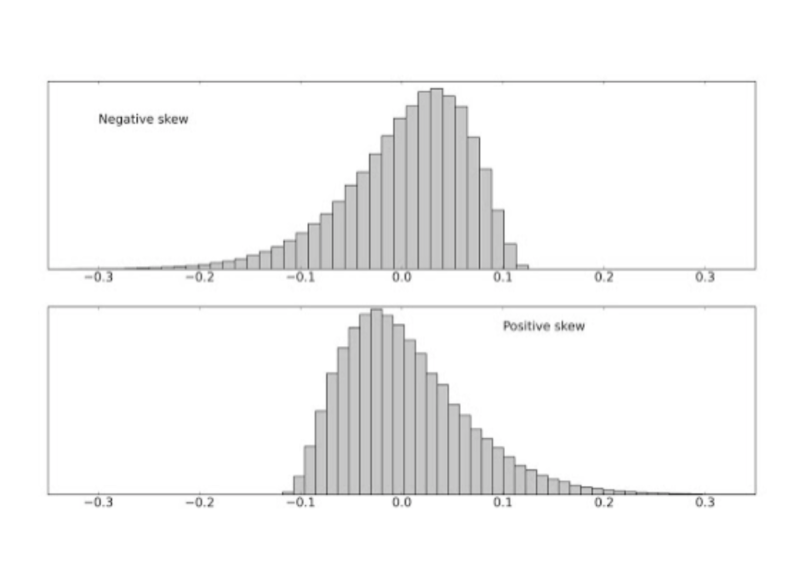

Salience theory explains well-documented investor skewness preferences — the overpricing of assets with a positive skew (larger right tails, like lottery tickets) and the underpricing of assets with a negative skew (larger left tails). And the presence of limits to arbitrage (including the risk and costs of shorting) prevents sophisticated investors from fully correcting mispricings. The result, for example, is that small growth stocks with high investment and low profitability have positively skewed expected returns and have historically been overpriced relative to small value stocks. On the other side, disaster risk should pay an excessive premium, and short-volatility strategies in times of fear of large drawdowns for the underlying asset should have positive expected value.

The bottom line is that salience theory predicts that probabilities of the most salient (extremely favourable) outcomes are inflated, while probabilities of less salient (greater downside risk) outcomes are underweighted. The result is that the excess demand for the most salient stocks results in their overvaluation and lower future returns, while stocks with salient downsides become undervalued and earn higher subsequent returns.

Mathijs Cosemans and Rik Frehen contribute to the behavioral finance literature with their study Salience Theory and Stock Prices: Empirical Evidence, published in the May 2021 issue of the Journal of Financial Economics. They assumed “investors mentally represent a stock by the distribution of its past returns, viewed as a proxy for its future return distribution. Because these past returns have been realized, their objective probabilities are known. Investors who engage in salient thinking form a context-dependent representation of each stock by replacing the objective probabilities with decision weights that depend on the salience of the stock’s past returns. Specifically, we suggest that investors form beliefs about future returns by extrapolating salience-weighted daily returns over the past month.” They explained that they measured “the salience of a stock’s daily return by comparing it to the return on the equal-weighted CRSP index. Intuitively, when forming return beliefs, salient-thinking investors attach more weight to a 5% stock return on a day when the market is flat than on a day when the market is also up by 5%. Salience weights not only depend on the distance between stock and market returns but also on their level. For example, when a stock outperforms the market by 3%, this outperformance stands out more on a day when the market return is 0% than when it is 10%.”

When a stock’s highest past returns stand out, salience theory is positive, and investors actively seek risk and accept a negative risk premium. When a stock’s lowest past returns stand out, salience theory (ST) is negative, and investors overemphasise its downside risk. Investors then exhibit risk-averse behavior and demand a positive risk premium for holding the stock. Cosemans and Frehen thus hypothesised: “Because salience distortions stem from cognitive limitations, salient thinkers are assumed to engage in narrow framing: when evaluating a stock, they do not think about its contribution to the return of their portfolio. The salience of a stock’s return is therefore determined only by its relative difference from the market return and does not depend on investor-specific characteristics. Consequently, salience-driven demand for stocks will be correlated across investors and can exert pressure on prices, given limits to arbitrage that prevent rational investors from correcting mispricing. We thus expect the predictive power of the salience theory variable for future returns to be stronger among stocks for which arbitrage is more costly. We further predict the salience effect to be more pronounced among stocks with greater ownership by individual investors, typically assumed to be less sophisticated than institutional investors and therefore more prone to salient thinking.”

Their data sample included firms listed on the NYSE, AMEX and Nasdaq over the period 1926-December 2015, excluding stocks with a closing price less than $5 per share at the end of the previous month. Following is a summary of their findings:

Stocks with salient upsides earn lower returns over the next month than stocks with salient downsides—the return difference between stocks in the highest and lowest ST deciles was statistically significant and economically large.

The average return for the zero-cost strategy that buys high-ST stocks and shorts low-ST stocks ranged from -1.28% per month (t-stat = 10.7) for the equal-weighted (EW) portfolio to -0.60% (t-stat = 4.1) per month for the value-weighted (VW) portfolio.

The return differences were not explained by standard market, size, value, momentum and liquidity factors, with five-factor alphas ranging from -1.44% (t-stat = 12.5) (EW) to -0.80% (VW) per month (t-stat = 5.2).

The salience effect could not be explained by the investment and profitability factors in the Fama and French six-factor model, with six-factor alphas of -1.32% (t-stat = 11.0) (EW) and -0.64% (VW) (t-stat = 3.9).

There is a stronger cross-sectional relation between ST and future returns among stocks with higher retail ownership and greater limits to arbitrage.

The predictive power of ST is stronger during high-sentiment periods, when unsophisticated investors are more likely to participate in the market. The monthly return on the EW high-low ST portfolio equaled -1.41% following high sentiment and -0.88% following low sentiment. The difference of 53 basis points was significant at the 5% level. The return spread between the VW high- and low-ST deciles widened by 72 basis points (t-stat = 2.44) after periods of high investor optimism.

Stocks in the extreme ST deciles were smaller than those in the other deciles. Their average market cap was about one-half that of the average stock.

High ST stocks are not penny stocks, as they had an average price of about $20.

Total and idiosyncratic skewness increase with ST (greater risk but lower returns).

The salience effect is much weaker when ST is constructed using open-to-open instead of close-to-close returns (the ST effect is entirely intraday)—consistent with their conjecture that retail investors make trading decisions based on the close-to-close returns they observe. Since a change in the return definition does not alter the fundamentals of the firm, this finding is hard to reconcile with a risk-based explanation for the salience effect.

The salience effect cannot be explained by the short-term reversal effect.

Their findings led Cosemans and Frehen to conclude that their finding that the negative relation between salience theory and future returns was particularly strong among small stocks, illiquid stocks and stocks with high idiosyncratic risk, low institutional ownership and low analyst coverage provides strong empirical support for the predictions of the salience model. They added: “Collectively, these results lend support to a behavioural interpretation of the relation between the salience theory measure and future returns.” Their paper contributes to the behavioural finance literature by providing strong empirical evidence on the cross-sectional asset pricing implications of theory of choice under risk in which preferences are driven by the psychologically motivated mechanism of salience.

Investor takeaway

Cosemans and Frehen demonstrated that because of the salience-induced distortions in attention allocation, investors are attracted to stocks with salient upsides. The excess demand for these stocks leads to their overvaluation and thus lower future returns. On the other hand, stocks with salient downsides become undervalued and earn higher subsequent returns. The takeaway for investors is to learn to ignore recent performance and thus not become subject to the irrational behaviour predicted by salience theory. This becomes particularly important during periods of high investor sentiment. Forewarned is forearmed.