Practitioners still pay too little attention to academia

Comments Off on Practitioners still pay too little attention to academia

By JOACHIM KLEMENT

I recently read a paper that claimed that practitioner research has become increasingly more reliant on academic research and less on non-academic and unpublished research (e.g. from brokerage firms). As someone who intensively uses academic research in his work, I was encouraged by this claim — until I read how the study was done.

The study by Jerry Parwada at UNSW Business School in Sydney, Australia, looked at the articles published in practitioner journals like the Financial Analysts Journal or the Journal of Portfolio Management and what papers were cited by both academics and practitioners. Then they showed that academics tend to cite academic papers and very rarely cite non-academic work. Meanwhile, practitioners tend to cite non-academic work much more often than academic work. This has broadly stayed the same over time, but there is a slight tendency for practitioner articles to cite more academic research since 2008.

Quality of practitioner articles has improved

However, as someone who has published a dozen or two articles in practitioner journals my impression is that practitioners have become more academically minded. Instead, the requirements and standards of practitioner journals have significantly increased over the last decade.

Today, some of the practitioner articles published a decade or two ago would be rejected outright as insufficiently sourced and researched. And that is good because only high-quality material should be published in a journal, whether it is academic or practitioner-oriented.

Nice charts, shame about the “research”

It is bad enough that so many brokers can publish “research” that is obviously nonsense and simply a case of wishful thinking to justify whatever view the analyst or the firm has. When I was working on the buy side, I tried to stay away as far as possible from these analysts who just came up with a few nice charts without any evidence that whatever “correlation” they showed over the last couple of years would hold in the future.

I am still surprised how many followers people can have on Twitter by just posting a bunch of charts every day that seem to show some correlation or another. As someone who is a professional, I so often find myself shaking my head at these charts because I know that if the timeframe would have been extended just a little bit, the “correlation” would break down altogether. But, apparently, people love to pin their hopes on these charts instead of checking the data for themselves.

The gold standard

Instead, in my work, I gravitate to people who are able to support their views with good research that is grounded in academic results (which remain the gold standard of finance, no matter its flaws and failures). And this is also why I tend to write on academic research a great deal. I form my opinions based on sound research, not based on some tables with past performance numbers or common market knowledge.

Using academic research as the starting point of your own research doesn’t mean you are always going to be right. But it means you are practising evidence-based research that has as a starting point empirical observations that have been checked and checked again by some of the brightest people on the planet. And that reduces your chances of losing money and increases your chances of being on the right side of the trade.

Thank goodness, I do see more and more of that in practitioner journals. Unfortunately, though, I don’t perceive a rise in evidence-based investing in the practitioner community as a whole — which is why it can still be an advantage for those who practise it.

JOACHIM KLEMENT is a London-based investment strategist. This article was first published on his blog, Klement on Investing.

Joachim is a regular contributor to TEBI. Here are some of his most recent articles:

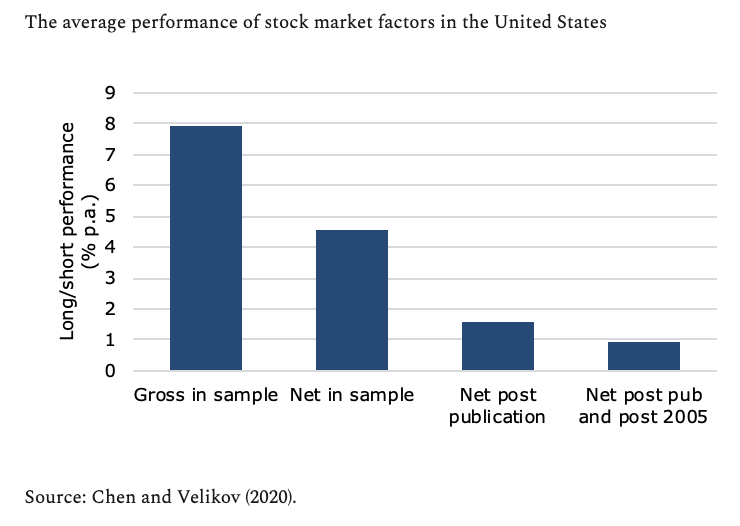

No more room at the factor zoo

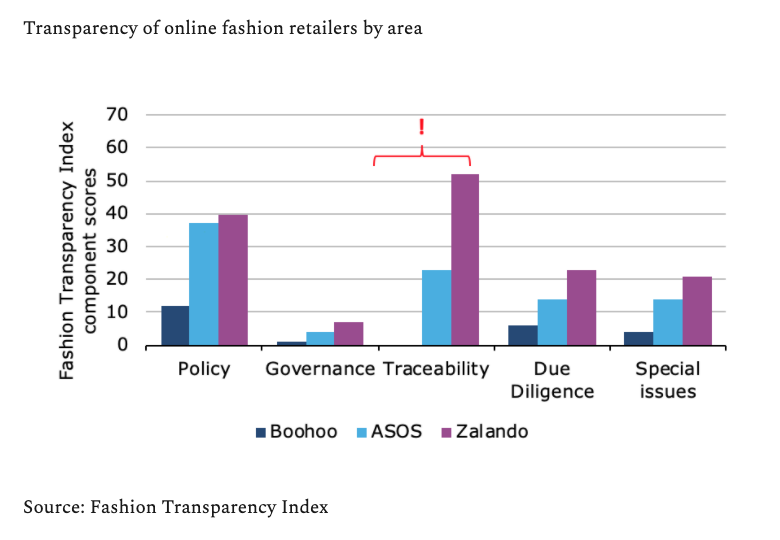

Boohoo teaches ESG investors a lesson

Stop admiring your successful trades

Is there a link between intelligence and performance?

Wall and Main are two different streets

Is book-to-market still the best measure of value?

What are you going to read next? Here are some suggestions:

Investing shouldn’t be a gamble

Are you still playing by the old rules?

The best friend investors have ever heard of

Do you think you’re smarter than Terry Smith?

FIND AN ADVISER

Did you know that TEBI can put you in touch with an evidence-based financial adviser in your area?

If you’re looking for advice on your investments or on your financial situation in general, simply click on this link and enter your name and email address. You will then be sent a short questionnaire to complete. Your answers will enable us to identify a suitable firm for you to speak to.

We will only recommend advisers who share our evidence-based investment philosophy and who we know and trust. If we can’t help you we will tell you.