Three golden rules of investing

Comments Off on Three golden rules of investing

What are the golden rules of investing? There are few people better qualified to answer that question than DAVID BOOTH. David is one of the co-founders of Dimensional Fund Advisors, an asset management firm that bases everything it does on peer-reviewed academic evidence. There are, David explains, three things more than any other that investors need to do.

We started Dimensional in 1981 around a set of beliefs.1 These ideas remain core to our business and key to the experience we deliver.

Investing is a science

Professional money managers have offered their services for centuries, but until the 1960s, there was no empirical way to hold them accountable for their results. When computers became powerful enough to analyse immense amounts of data, researchers could start gathering and learning from historical stock returns. Now economists could measure the success of different investment strategies compared with the performance of the broader market. The science of finance took off.

Early pioneers of this new academic discipline discovered that:

- Diversification reduces risk.

- Uncertainty creates opportunity.

- Flexibility adds value.

- Conventional active management isn’t worth the cost.

“Conventional active management” is just another way of naming a strategy that relies on stock picking, market timing, or both. Stated a different way, it’s people who think they can beat the market. Once historical stock-return data had been analysed, early empirical research showed that conventional active management delivered inconsistent returns and charged high fees. Not only did active managers not beat the market, they actually did worse than the market on average.2

This revelation was a shock to the investment establishment, which didn’t know any better because stock picking was just the way things were done. Investing in the total market, using a highly diversified, long-term strategy, was shown to provide a better investment experience than trying to outguess the market by picking stocks or timing the market.

In response to this groundbreaking research, a group of young money managers collaborated on developing the first index fund. I was a member of that crew of data dogs. Back in the early 1970s, we weren’t sure the strategy we were trying to implement would work. While academics had tested their hypotheses using data going back decades, we were using real money in real markets. Indexing delivered what it promised—it didn’t beat the market (it wasn’t supposed to), but it beat conventional active management. Millions of people all over the world have been able to realise their financial goals because of the growth and relative stability provided by index funds.

At its best, science points the way to innovation. We started Dimensional so we could improve upon indexing. By trading with patience and taking advantage of the flexibility that comes from considering a range of securities with similar characteristics, we believed we could deliver better investment outcomes. And it has worked out that way.

As new research identified ways to improve on the capitalisation weighting of index funds, we saw additional ways to add value. We designed portfolios that gave greater weight to smaller firms and lower-priced stocks.

Investing is an art

As with most sciences, the “facts” of investing are clear. Nearly all the academic insights of the past 50 years have been based on publicly available research. Contributions to the science of investing have been published worldwide and are widely accessible to anyone who’s interested in learning about them. Why, then, are there so many strategies available to those looking to invest their capital? What makes a particular money manager stand out when they all have access to the same research?

I believe the answer lies in what I think of as “the art of the science”. The art of the science of investing comes into play when research is interpreted and implemented in public markets.

Financial economics is a social science. Unlike math, which demands proofs and delivers exact answers, research in finance yields insights. These insights allow room for interpretation. And putting theory into practice requires judgment. In many ways, it’s similar to medical science.

The art of the science of investing has two major components: engineering and execution. What do I mean by engineering? Everything that goes into deciding how to structure investment portfolios. This requires answering the question “What story is the data telling us?” In my mind, this is where human judgment becomes indispensable.

Just as important as the data are the people who interpret it. Dimensional’s Research team strives to constantly improve our strategies using the most valuable new research. It’s critical that they be able to distinguish signal from noise. And that takes judgment.

When I talk about execution, I’m referring to how an investment strategy is implemented. Once you know which strategies have been shown to improve results in the data, how do you bring them into the real world? As my friend Myron Scholes3 has said again and again, “Ideas are cheap. What matters is how you execute.”

Back in 1981, when I ran our “trading department” from the makeshift desk of my Brooklyn apartment, I knew that I could get the best possible deals for clients by using a flexible approach to trading. Index funds simply couldn’t be flexible, because they had to track their benchmarks. We were beholden to no one but ourselves, so we could save money and direct that savings to benefit our clients.

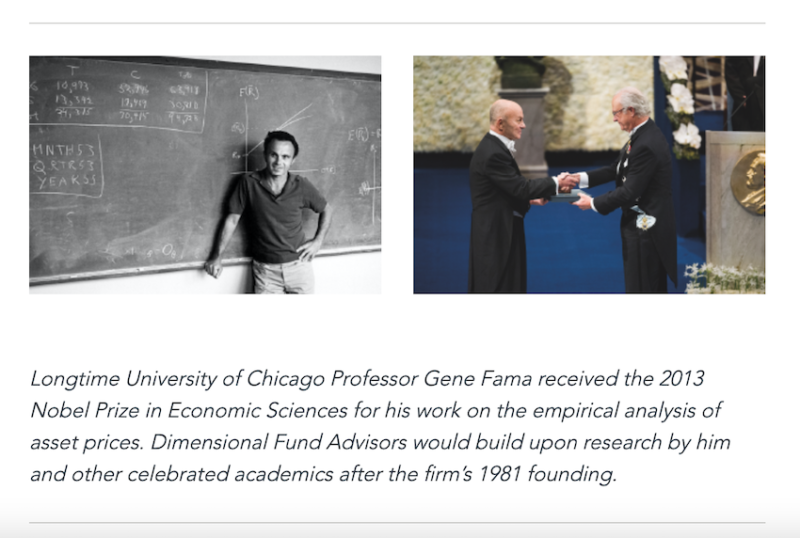

Another maxim to remember, this time from my colleague Gene Fama: “Models are not reality. If they were, we wouldn’t call them models—we’d call them reality!” All investment strategies can be simulated, but results will always be hypothetical. We have 41 years of proven, real-world experience — and real-world returns.

An investment manager isn’t worth much unless the returns from their judgment — so-called “alpha”—add up to more than the fees they charge. Many people say they choose index investing because the fees are so low. But in my mind, they’re leaving returns on the table: acknowledging the science without implementing the art. At Dimensional, we more than pay for ourselves with the judgments we make every day. Trading flexibly, paying attention to detail, understanding risk, and standing up for the rights of the investor through investment stewardship of the stocks we hold — these result in changes that might seem small but have huge long-term impacts.

Why? Because of the art of the science.

Investing is a practice

The science of investing has shown that there are structural ways to beat the market without trying to outguess it. Sometimes this idea can be hard to grasp, so I’ve found that analogies between life and investing can really help. One parallel that makes sense to me is comparing managing our money to managing our health.

Our bodies, minds, and bank accounts make it possible for us to live the lives we want. So it makes sense to take care of them in the most scientifically sound ways possible.

The golden rules of investing

Here, in my mind, are the ways we can use what we’ve learned from science to be the most responsible stewards of the things that matter most to us:

- Find a trusted professional who understands the science even better than you do.

- Adopt a long-term strategy you can stick with through thick and thin.

- Focus on crisis prevention, not crisis management.

1. Find a trusted professional

Most of us, given the opportunity, would rather trust an accomplished physician to manage our health than take on the responsibility ourselves. After all, physicians have specialised training, real-world experience, and access to tools outside the reach of the general public. Finally, they’ve taken an oath to prioritize the patient’s health over their own interests.

In the same vein, independent financial advisors are trained to adapt insights from financial science to each client’s individual situation. They look at clients’ financial health holistically and work with them to create a long-term plan that aims to accomplish their unique goals. And they provide a trusted partner who can help when times are tough.

2. Adopt a long-term strategy you can stick with

In both wellness and investment management, consistency is key. Knowing what to do is less than half the battle — you have to actually do it, over and over again, to see results. This means sticking to your plan, even when you’re not sure it’s working. Your understanding of what’s right has to overpower your desire to quit when things don’t seem to be going your way.

This might mean continuing to take that 45-minute daily walk even when you can’t see progress, or resisting the urge to get out of the stock market when returns are disappointing. The goal is cultivating a desire for a better future that gives you the willpower to tolerate uncomfortable feelings in the present.

Both health and investment discipline contribute to another important kind of wellness: peace of mind.

3. Focus on prevention and preparation

From heart disease to bank runs, the best preparation is often prevention. By the time the crisis happens, you’ve either avoided it or you’re better equipped to deal with it.

In health, this means drawing insights from scientific research about the habits and practices that lead to healthy outcomes, and then making them part of your routine in the most efficient way possible. In investing, this means essentially the same thing: adopting the insights from decades of empirical research, and then implementing them in an effective way at the lowest possible cost.

When you have both science and a trusted professional on your side, you never feel alone when weathering life’s inevitable storms. You’re well-equipped to stick to a long-term strategy that can best position you to achieve your goals. And even when things don’t go exactly the way you planned, you know you’re still probably going to be OK.

That’s peace of mind money can’t buy.

FOOTNOTES

Dimensional Fund Advisors LP founded in 1981.

2Eugene F. Fama and Kenneth R. French, “Luck versus Skill in the Cross-Section of Mutual Fund Returns,” Journal of Finance 65, no. 5 (2010): 1915–1947.

3Independent Director, Dimensional Funds, 1981-2021

DISCLOSURES

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorised reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

PREVIOUSLY ON TEBI

Self-attribution bias in active management

What do the changes at SJP mean?

Settling for average? No, indexing is a winning strategy

FIND AN ADVISER

As David booth says, the evidence is clear that you are far more likely to achieve your financial goals if you use a trusted professional to help you and have a long-term plan.

That’s why we offer a service called Find an Adviser.

Wherever they are in the world, we will put TEBI readers in contact with an adviser in their area (or at least in their country) whom we know personally, who shares our evidence-based investment philosophy and who we feel is best able to help them. If we don’t know of anyone suitable we will say.

We’re charging advisers a small fee for each successful referral, but you will pay no more than you would if you contacted the adviser directly.

Need help? Click here.

© The Evidence-Based Investor MMXXIII